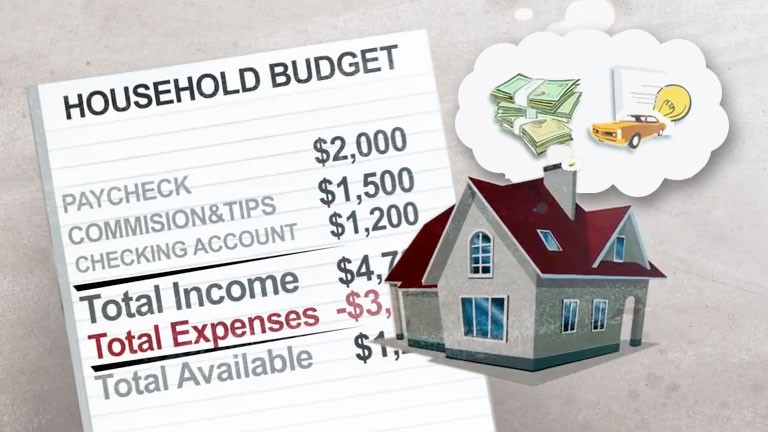

A budget is a plan, an outline of your future income and expenditures that you can use as a guideline for spending and saving.

Only 47 % percent of Canadians use a budget to plan their spending. But Canadians are feeling more in debt than ever with 90% saying they have more debt today than five years ago. A budget can help you pay your bills on time, cover unexpected emergencies, and reach your financial goals — now and in the future. Most of the information you need is already at your fingertips.

Setting Up A Monthly Budget

It’s a good exercise to document your own actual spending habits for a month or two, and then compare them to this model. This can be a quick way to find out if you are overspending in certain areas.

1. Add Up Your Income

To set a monthly budget, you need to determine how much income you have. Make sure you include all sources of income such as salaries, interest, pension, and any other income sources, including a spouse’s income if you’re married. If you get paid once per month, that’s easy — just look on your pay stub for the after-deductions total. If you don’t get paid monthly, you’ll need to do some math. Determine your pay after deductions, and then use the following chart to help figure out what your monthly take-home pay is:

- Weekly cheques, multiply by 4.333

- Every-two-week cheques, multiply by 2.167

- Twice-a-month cheques, multiply by 2

- Irregular annual income, divide the net total by 12

You also want to make sure you add in other sources of income, such as interest income, spousal support, child support, tenant rent, and other payments. As with your paycheques, determine a monthly average for these streams. Using the downloadable Household Budget, write a dollar figure next to each relevant income source. Make sure that the figure you write down is the amount you receive from each income source on a monthly basis.

2. Estimate Expenses

The best way to do this is to keep track of how much you spend each month. The first step is to sum up just where — and how much — you think you are spending. The worksheet divides spending into fixed and flexible expenses. If some of your expenses for one or more category change significantly each month, take a three-month average for your total. You don’t have much influence over what you pay towards income tax (apart from contributing more generously to your RRSP). As for the other categories, you might prefer to split them into more narrow subgroups (separating food, clothing, and entertainment, for example).

3. Figure Out The Difference

Once you’ve totalled up your monthly income and your monthly expenses, subtract the expense total from the income total to get the difference. A positive number indicates that you’re spending less than you earn – congratulations! A negative number indicates that your expenses are greater than your income and gives you an idea of where you need to trim expenses and by how much.

Well done! You’ve created a budget. The next step is to make adjustments to this outline in order to achieve your financial goals. Track your budget over time to make sure you’re on track. You need to start making records of your actual income and expenses.

This information will help you to understand any “budget variances” – the difference between the amount you planned to spend in a certain category, and the amount you actually spent. Prepare to be surprised for the first couple of months. You may not need to track your spending indefinitely. Usually, a couple of months are all you need to get an idea of where your money is going.

For more help with your own budget, download a Household Budget template.

Leave A Comment